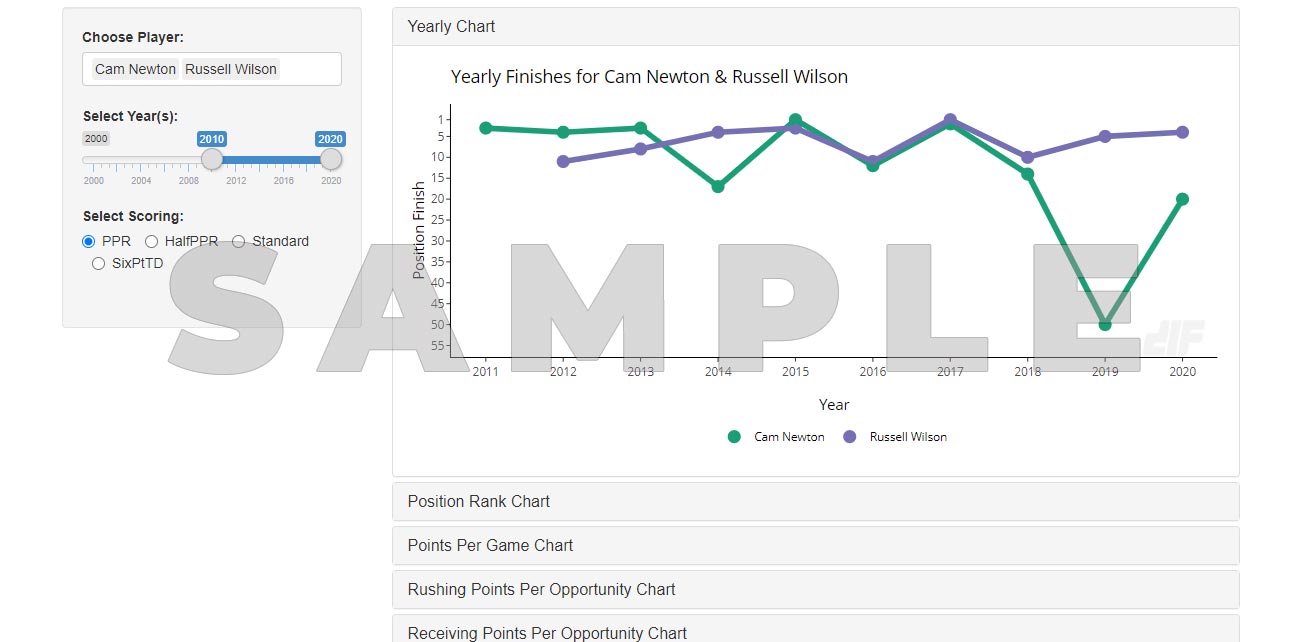

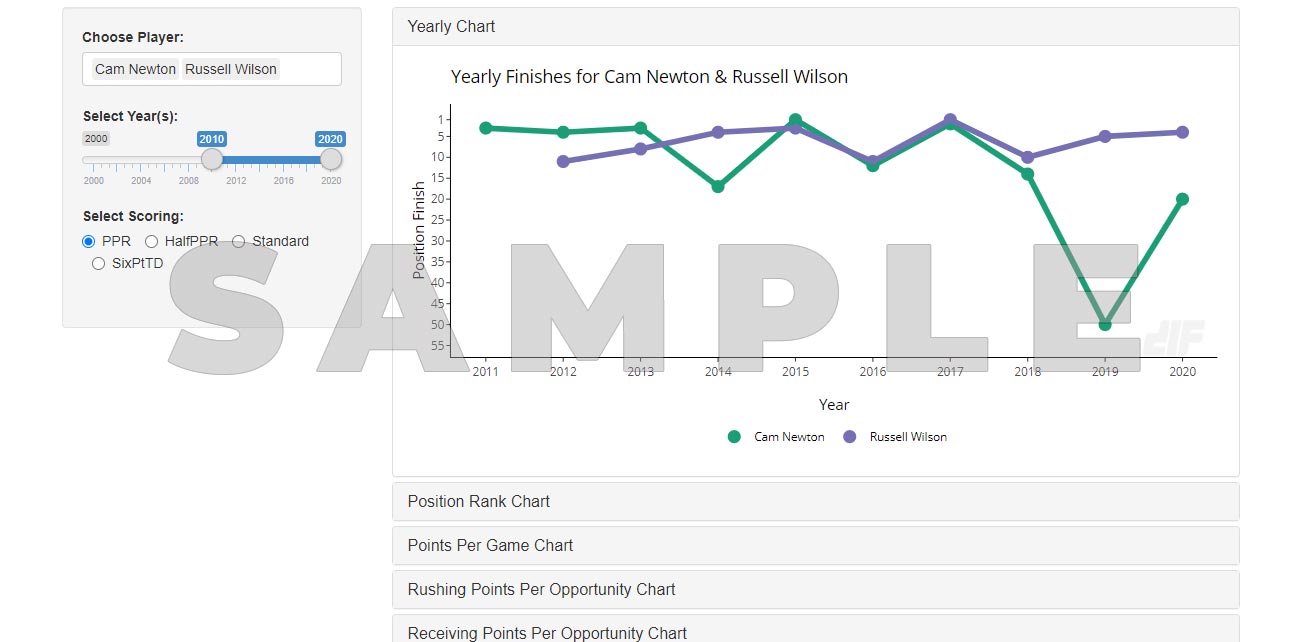

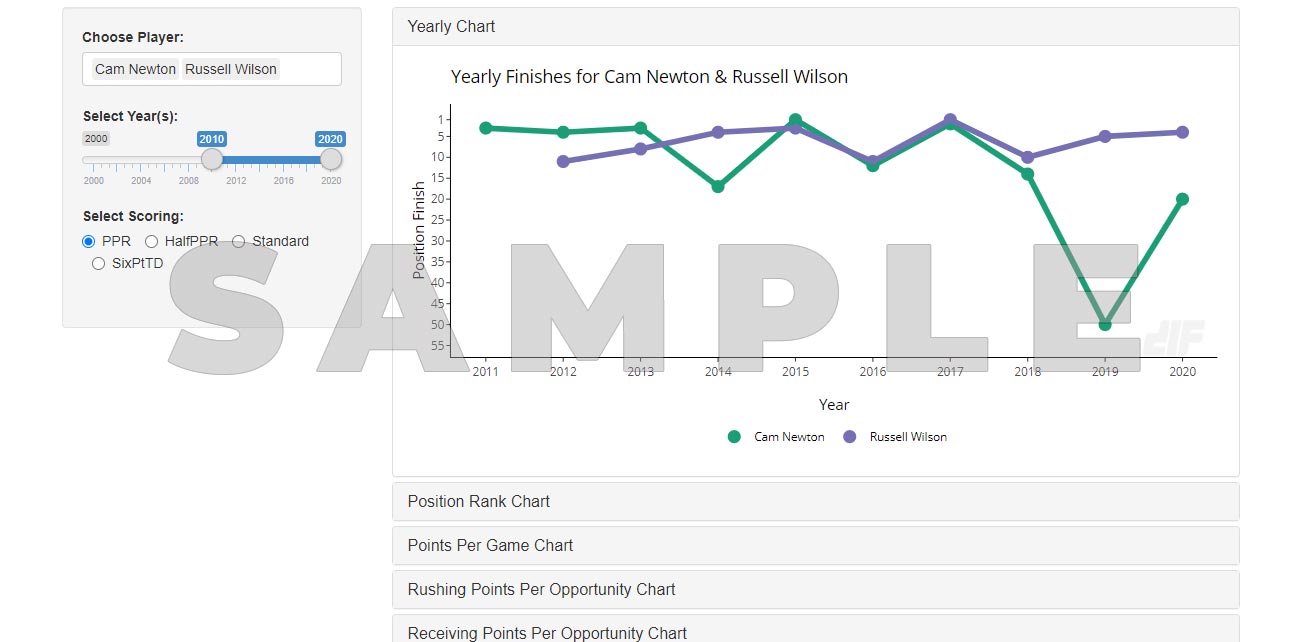

Explore and compare annual performance data for one or more players.

For a detailed explanation on how to use the Yearly Data App, please read the tutorial.

GET IN THE GAME!

Gain Instant Access to this feature and so much more.

A full year of access is only $49.99.

Try DLF Premium for only $9.99 with a Monthly Subscription.

You can also get a DLF Premium Membership for FREE! Find out how.

Premium membership provides access to all of our awesome dynasty content for an entire year. You also gain access to the best dynasty fantasy football resources in the industry.

• The best dynasty rankings in the industry

• Dynasty, Rookie & Superflex ADP

• Dynasty Trade Analyzer and other tools

• Our annual Rookie Draft Guide

• 365 days of content, tools, advice and support

• And so much more!

Join DLF Today!

Want more info about DLF Premium?

Find out more

Have questions or need some help?

Contact Us

Already a DLF Premium Member?

Log in now!